Have a great idea but not sure how to structure it or communicate with potential partners?

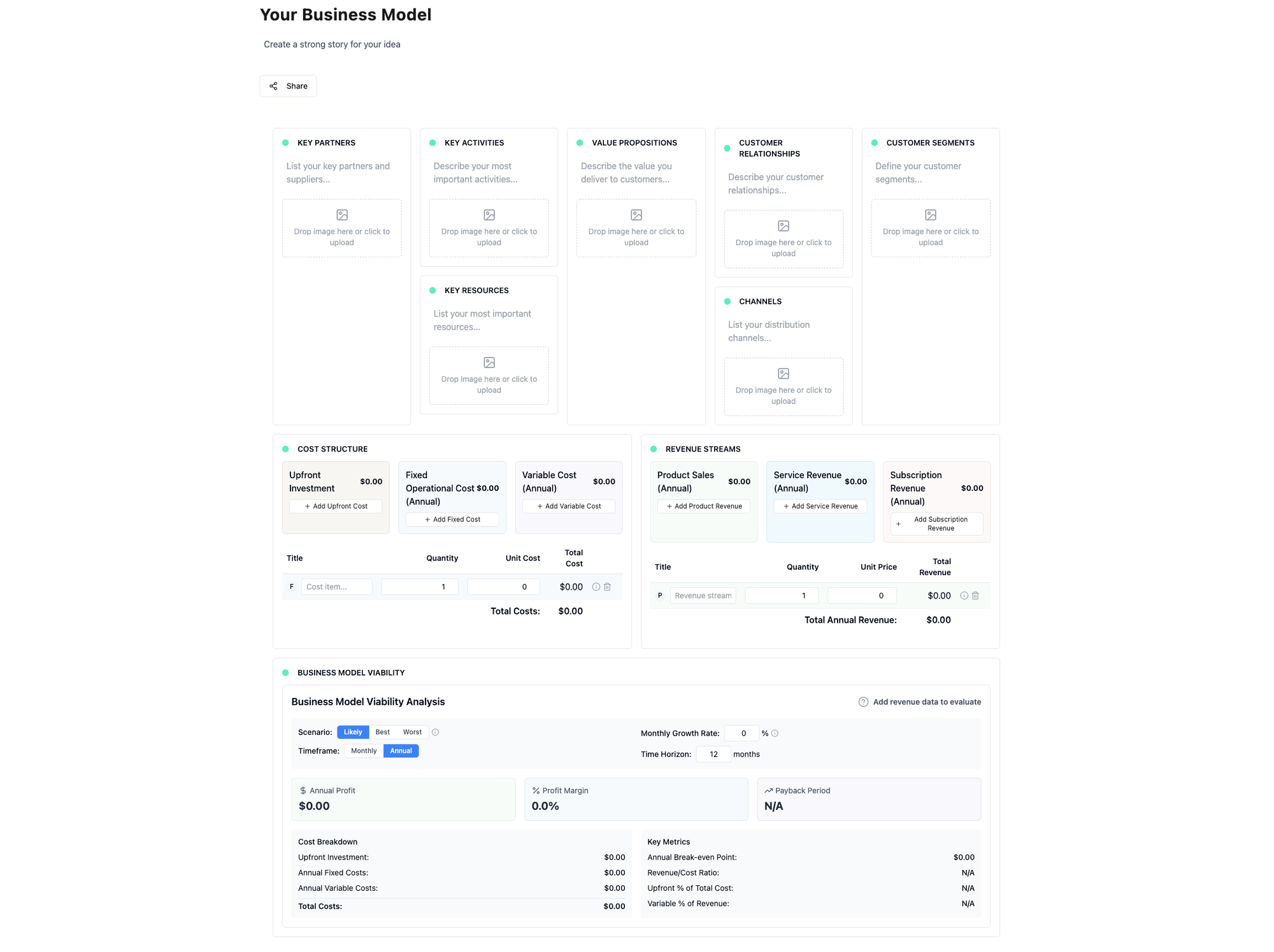

Many people use the Business Model Canvas for workshops, but miss the real‐number evaluation. After all, it’s not about the fancy words on Post‐its—it’s about answering a crucial question: Will this business model work financially?

That’s why I built this Business Model Viability tool. It offers a straightforward way to outline your costs, project revenue, and gauge viability—all without complex financial jargon.

Why Is It Valuable?

• Easy Overview

Quickly capture your core business elements—Key Partners, Activities, Value Propositions, and more—in one convenient screen.

• Guided Financial Structure

Separate Upfront, Fixed, and Variable costs, then compare them against Product, Service, or Subscription revenue streams to estimate profit or margin.

• Scenario & Growth Insights

Toggle between Likely, Best, or Worst scenarios, and factor in monthly or annual growth to see how revenue and costs evolve over time.

• Ideal for Collaboration

Easily share a clear, visual snapshot of your business model with co‐founders, stakeholders, or mentors—helping everyone stay on the same page.

Simple Steps to Get Started

1. List Your Business Elements

Fill in Key Partners, Activities, and other blocks to paint a high‐level picture.

2. Add Costs & Revenue Streams

Separate Upfront, Fixed, and Variable costs, then add your projected revenue types.

3. Adjust Growth & Time Horizon

Set a timeframe (e.g., 12 months) and growth rates if applicable.

4. Review the Viability Analysis

Check out annual profit, profit margin, break‐even point, or payback period—all visible at a glance.

How the Viability Section Works:

In this section, the tool automatically calculates key financial metrics—such as annual profit, profit margin, break‐even point, and payback period—based on the costs and revenue streams you’ve entered. By toggling between Likely, Best, and Worst scenarios, adjusting the timeframe (monthly or annual), and factoring in a growth rate, you’ll see how different assumptions affect your bottom line. This snapshot offers a quick, high‐level view of your business model’s financial health—helping you identify areas to optimize or pivot. Remember, these figures are only as reliable as the data you provide, so always validate with real‐world feedback and professional advice.

Learn more about business model design:

1. Business Model Generation by Alexander Osterwalder and Yves Pigneur

This practical handbook introduces the Business Model Canvas, a strategic tool for developing new or documenting existing business models. Co-created by 470 practitioners from 45 countries, it's a comprehensive resource for visionaries, game changers, and challengers striving to defy outdated business models and design tomorrow's enterprises.

2. Blue Ocean Strategy by W. Chan Kim and Renée Mauborgne

This groundbreaking work challenges traditional competitive strategies by advocating for the creation of "blue oceans"—untapped market spaces ripe for innovation. Backed by a study of 150 strategic moves spanning more than a hundred years and thirty industries, the authors provide analytical frameworks and tools to systematically create and capture blue oceans.

3. The Invincible Company by Alexander Osterwalder, Yves Pigneur, Alan Smith, and Frederic Etiemble

Building on their previous work, the authors explore what makes companies resilient and invincible in the face of disruption. The book presents new tools like the Portfolio Map to help leaders systematically assess and improve their business models and value propositions.

Disclaimer

This tool is designed to provide general guidance and a high‐level financial overview of your business concept. It is not a substitute for professional accounting or legal advice. The projections and scenario results are estimates based on the information you provide—always validate with real‐world data and, if necessary, consult with financial professionals.