In a competitive market, setting the right prices and sales target can make or break a business. MarginMap is a tool designed to simplify this process, empowering business owners to explore and refine their pricing strategies with data-driven insights. By simulating various financial scenarios, MarginMap helps you understand your profitability potential and make informed decisions.

Key Features of MarginMap

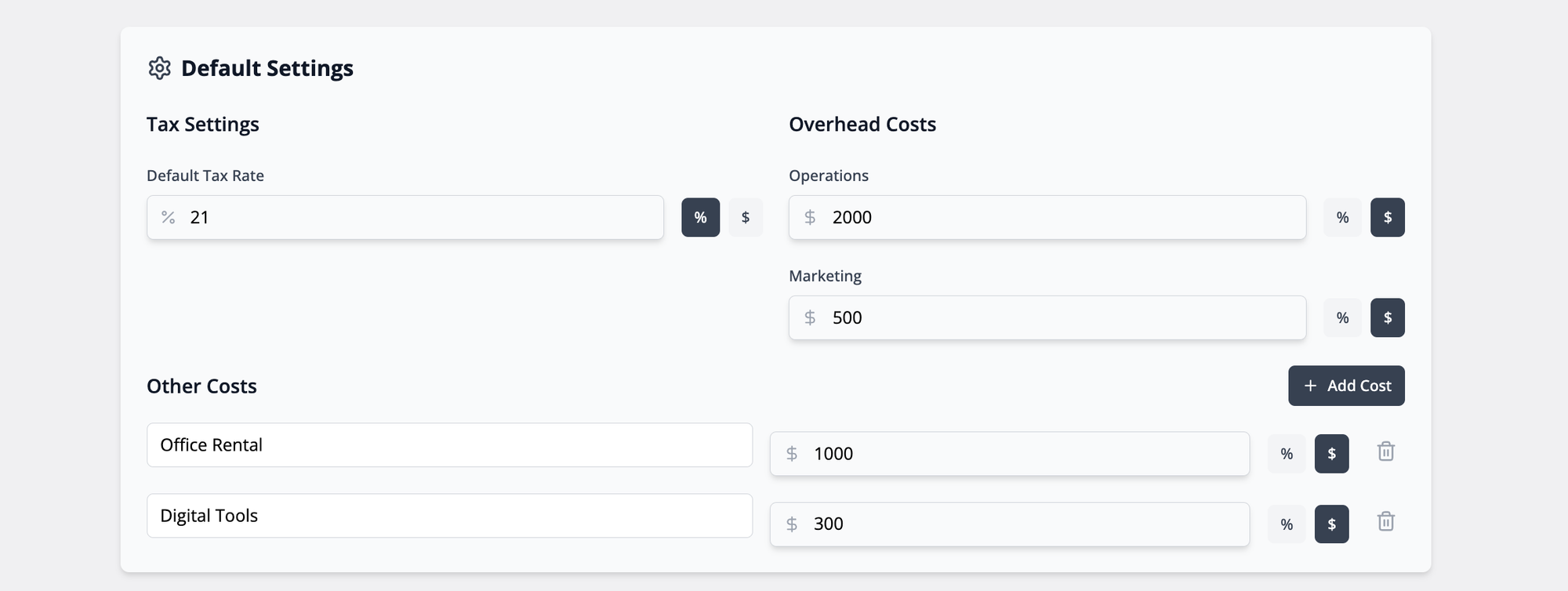

- Default Settings for Taxes and Overhead Costs

Set up a default tax rate and input overhead costs, such as operations and marketing expenses. These baseline settings ensure that all simulations reflect your true cost structure.

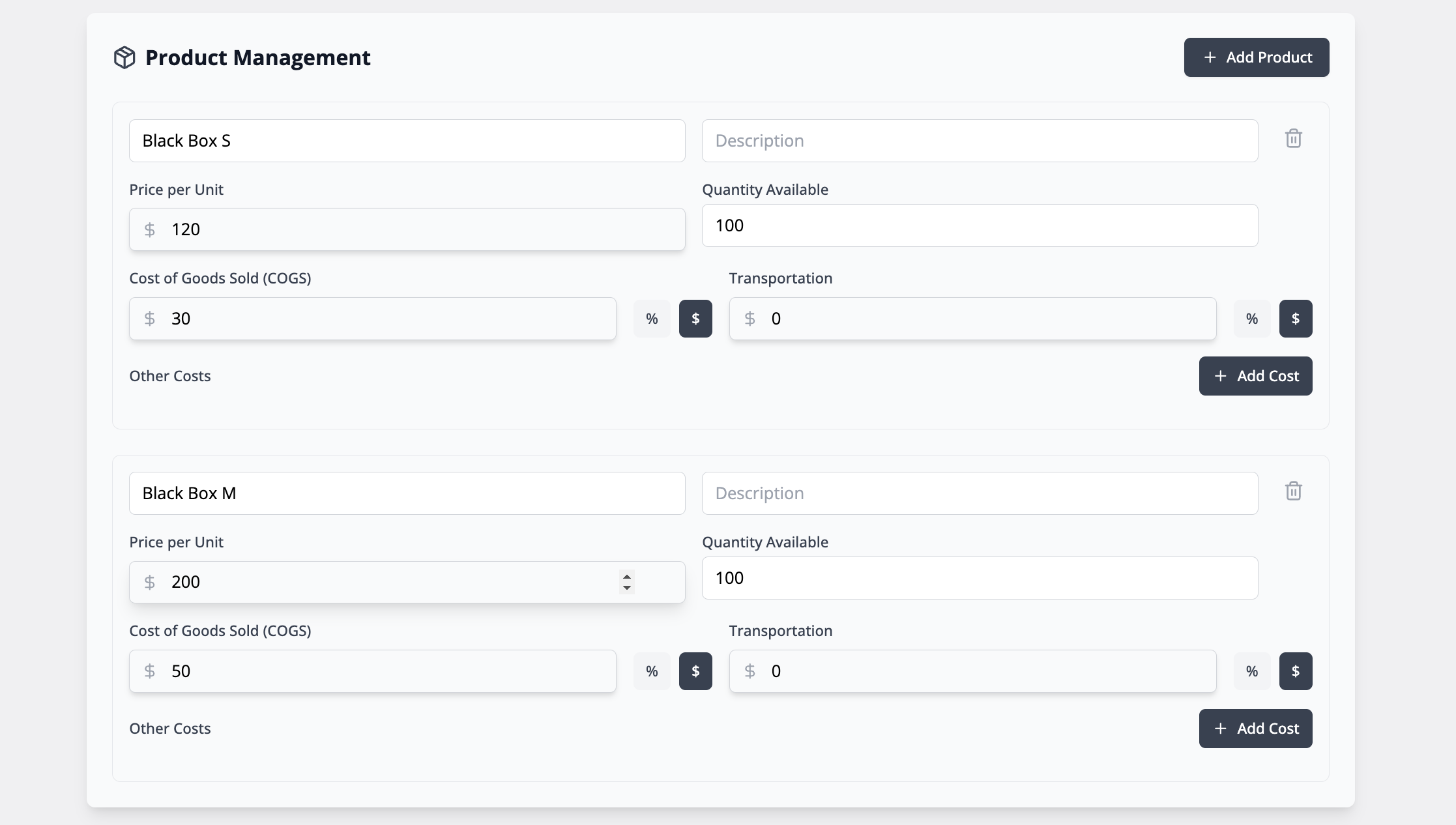

- Product Management

Add products with details like price per unit, quantity available, Cost of Goods Sold (COGS), and transportation costs. Each product entry allows for a clear, granular breakdown of individual product costs, giving you control over profit margin analysis at the product level.

- Scenario Simulation

Experiment with pricing adjustments and sell-through rates to see how changes impact your total revenue, profit, and margins. You can run simulations for individual products or your entire portfolio, giving you flexibility to test different scenarios and optimize pricing.

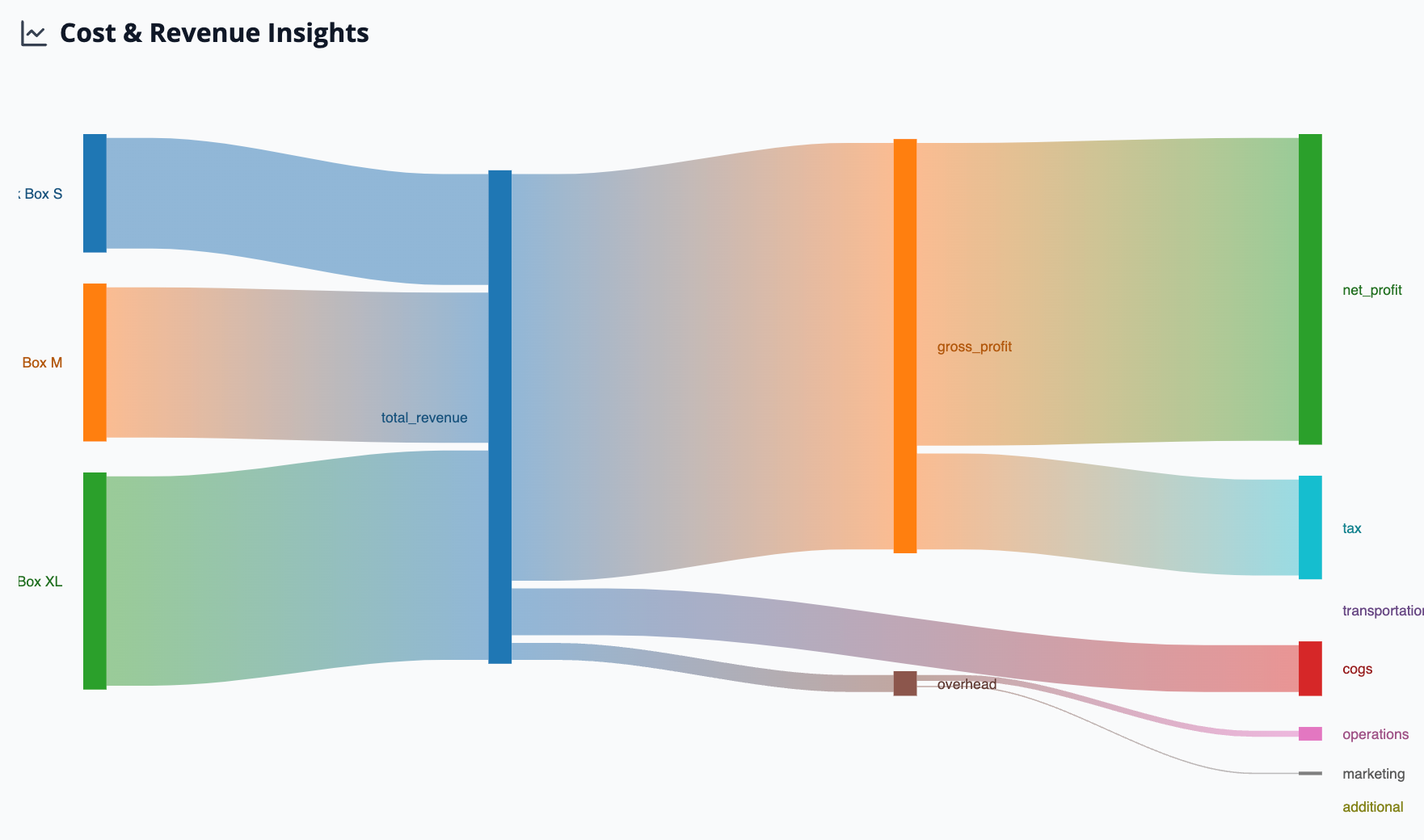

- Cost & Revenue Insights with Sankey Diagram

- MarginMap uses a Sankey Diagram to display the flow of revenue, costs, and profits. This type of chart is handy because it shows how each dollar moves from revenue to various costs (like operations and marketing) and ultimately to profit.

- How to Read the Sankey Diagram in MarginMap

- Revenue Source: On the left side, you’ll see your total revenue, which flows into different cost categories.

- Cost Categories: Revenue flows through segments representing costs like COGS, transportation, operations, and marketing. The width of each segment indicates the proportion of revenue spent in that area.

- Profit Output: After all costs, the remaining segment represents your profit, giving you a clear picture of margins.

When to Use the MarginMap Tool

MarginMap is a versatile tool that helps business owners make strategic financial decisions by providing a comprehensive view of costs, revenue, and profitability. Here are some key moments when MarginMap can be especially valuable:

- Planning a Discount Campaign

When planning a discount, MarginMap helps you simulate the effects of price reductions on overall profitability. By modeling the potential increase in sales volume against the lower revenue per unit, you can assess whether a discount strategy will boost profits or erode margins. This enables you to strike the right balance between attracting customers and maintaining profitability. - Visualizing Quarterly Results

At the end of a quarter, MarginMap provides a detailed breakdown of how revenue is distributed across costs and profit. With its insights, you can identify where expenses are concentrated, compare them against revenue and profit goals, and prepare reports that align with your objectives. MarginMap’s visualizations and data help you quickly assess financial health and communicate results effectively with stakeholders. - Setting Realistic Sales Objectives

When setting sales targets, MarginMap allows you to simulate different pricing, volume, and cost scenarios. This helps you understand how various sales volumes and pricing strategies affect profitability. By testing these scenarios, you can set ambitious but achievable sales goals, grounded in data-driven insights about profit margins and revenue potential. - Analyzing Cost Increases

If your operational costs or supplier prices rise, MarginMap enables you to model the impact of these changes on your profitability. By adjusting inputs for cost increases, you can see if price adjustments are needed or if cost-cutting measures should be prioritized elsewhere. This feature helps you maintain profitability even in the face of rising expenses, supporting informed decision-making. - Assessing New Product Viability

When considering a new product, use MarginMap to simulate its cost, pricing, and revenue potential. The tool’s insights allow you to assess whether the new product will contribute positively to your overall profitability or if adjustments to pricing or cost structure are needed before launch. This empowers you to make well-informed choices about expanding your product line.

Conclusion

MarginMap is more than just a pricing tool—it’s a strategic companion for anyone looking to make smarter, more profitable business decisions. By combining simplicity with powerful insights, MarginMap enables business owners to navigate their path to profitability confidently.

Ready to explore your profitability? Try MarginMap today and start making data-driven decisions with ease.

*Disclaimer

MarginMap is designed as a simplified tool to help business owners explore basic pricing strategies and visualize cost structures. While it provides valuable insights, it is not intended to replace advanced financial modeling or comprehensive business analysis. For more sophisticated models, strategic planning, or tailored consultancy services, please feel free to reach out to me. I’d be happy to assist you in building a more detailed and customized approach to achieving your business goals.

Variable Explained

| Input Variable | Description | Purpose |

|---|---|---|

| Default Tax Rate | The standard tax rate applied to all calculations. | To include tax impact on profits and simulate post-tax profitability. |

| Overhead Costs | Fixed expenses such as operations and marketing costs, which can be entered as a dollar amount or percentage. | To represent fixed costs in the overall cost structure, ensuring simulations reflect real operational expenses. |

| Price per Unit | Selling price for each unit of the product. | Used to calculate revenue based on sales volume and to assess the impact of pricing adjustments on profit margins. |

| Quantity Available | Number of units available for sale. | Helps calculate potential revenue and allows scenario simulations based on inventory. |

| Cost of Goods Sold (COGS) | Direct costs associated with producing each unit, which can be entered as a dollar amount or percentage. | Essential for calculating gross profit margins, providing insight into the direct profitability of each product. |

| Transportation | Costs associated with shipping or delivering the product. | Accounts for additional variable costs per product, providing a more accurate breakdown of profit after all direct expenses. |

| Other Costs | Any additional variable costs not included in COGS or transportation. | Allows users to factor in miscellaneous expenses, offering a complete view of all costs associated with the product. |

| Simulation Type | The type of simulation to run, either overall or product-specific. | Enables different analysis types, whether focusing on the entire product portfolio or individual items, for targeted profitability insights. |

| Price Adjustment | The percentage or dollar change in product price for scenario testing. | Allows users to test the effects of discounts or price increases on total revenue and profitability, aiding in pricing strategy decisions. |

| Sell-Through Rate (%) | Expected percentage of available stock that will be sold. | Provides a realistic forecast for revenue and profitability based on anticipated demand, useful for setting achievable sales goals. |